Fundraising is hard

don't do it alone

Join the Growth Services programme offered by 28DIGITAL to receive unparalleled fundraising support. Our team of venture capital experts help European deep tech companies gain access to the financing they need to scale their businesses.

THIS IS HOW WE WORK

PREPARE: Raising a Series A is a lot of work. From pitch decks to projections, from deal structure to the data room, it’s time to get organized. Double check, triple check, tighten and polish. With our help, you’ll build the confidence and competence to ace your investor meetings.

CONNECT: Nothing beats a good network. Expand your fundraising search well beyond your home country. Our fundraising experts have personal relationships with investor all across Europe. What’s more, we know what they want. Get introduced to investors whose interests match your tech, geography and ticket size. Startups with an international investor expand faster and have a better chance to do later a large Series B round.

RAISE: You only get one chance to make a first impression. Make it count. With our training and introductions, you’ll be poised to deliver the right message to the right audience at the right time. Let the investors see your purpose, your potential and your growth plan. Find a strategic and value adding investor that understands your business. Get a valuation that keeps the equity where it belongs. Above all, secure the capital influx you need to grow.

SECTORS OF EXPERTISE: 5 DIGITAL PRIORITY AREAS

Digital Industry covers the seamless process from production to retail and the related supporting functions such as logistics and consumer engagement to improve efficiency in production and retail.

Digital Industry covers the seamless process from production to retail and the related supporting functions such as logistics and consumer engagement to improve efficiency in production and retail.

Digital Cities leverages the digital transformation of the cities through centralised, participative and collaborative interactions between city actors: government, city service providers, industry, and citizens.

Digital Cities leverages the digital transformation of the cities through centralised, participative and collaborative interactions between city actors: government, city service providers, industry, and citizens.

Digital Wellbeing aims at slowing down the growth of healthcare expenses while maintaining the quality of life during the working life and at higher age through prevention of and coping with mental and physical conditions.

Digital Wellbeing aims at slowing down the growth of healthcare expenses while maintaining the quality of life during the working life and at higher age through prevention of and coping with mental and physical conditions.

Digital Tech is the core enabler of the digital transformation by providing secure, robust, responsive and intelligent communications and computation facilities.

Digital Tech is the core enabler of the digital transformation by providing secure, robust, responsive and intelligent communications and computation facilities.

Digital Finance supports the creation of innovative tools and services to help the finance industry adapt to the challenges it currently faces. Robust yet agile and tailored financial services are essential for our economies, citizens and enterprises.

Digital Finance supports the creation of innovative tools and services to help the finance industry adapt to the challenges it currently faces. Robust yet agile and tailored financial services are essential for our economies, citizens and enterprises.

28DIGITAL FOCUS

Early Stage Startups

- 200k – 1 m€

- Finalizing product/services

- Attracting talents

- Winning grants and non-dilutive financing

- Winning first customers

- Going to the market

- Prepare fundraising

- Grants, government subsidies

- Friends and family, Love Money

- Business Angels

- Crowd funding

Established Scaleups

- 5 – 35 m€

- Increasing sales and production

- Growing internationally

- Recruiting a team

- Differentiating from competition

- Elaborating pricing strategy

- Defining a corporate strategy

- Developing a brand

- Improving margins and efficiency

- Venture Capital

- Corporate Venture funds

- Sovereign funds

- Family offices

- Debt, if possible

Mature Startups

- 10+ m€

- Developing new markets

- International expansion

- Acquisitions (?)

- New innovations

- Achieving market leadership

- Equity story

- Exits (IPO / sale to partners, trade sale)

- Capital development funds

- Venture debt

- PE funds

- Family offices

- Sovereign funds, EIB

THIS IS THE TEAM THAT WILL GET YOU THERE

Jari Mieskonen

Jari Mieskonen

Seasoned venture manager with experience of some +120 direct investments mainly in Nordics and Baltics area. He has been a board member of all direct investments he has executed and served several years in Invest Europe venture council, FVCA board and is currently chairman of Nordic Venture Network. He is more like generalist than focused specialist what comes to technologies. He has always protected founder’s interest in complex deal structures and kept neutral professionalism in deal making. Based on his long experience in the venture industry he has seen several cycles in the market and knows that timing is sometimes more important than maximum value.

Dr Daniel Auriel

Dr Daniel Auriel

Daniel is as "deeptech" as they get. He started his career in chemical and pharmaceutical R&D in large corporation such as Bayer and Stora Enso, before taking on various innovation, strategy and business assignments focused on advanced technologies in Germany, China, Israel and other regions. His work resulted in 7 products brought to the market, 1 business unit & 1 regional office created, and 1 new business model implemented.

Since 2015, he followed his passion for entrepreneurship & investments as VC investment manager (Capricorn Venture Partners), as venture partner for a start-up incubator/accelerator, and as angel investor as well as start-up advisor. He joined EIT Digital in 2019 where he covers the DACH region and has helped successfully close multiple fundraisings in areas such as MedTech/HealthTech, PropTech, Big Data, ClimateTech, AgroTech, etc.

Tomas Pulido

Tomas Pulido

Tomas is an Engineer turned Oil&Gas Operator turned Startup Strategic Advisor.

He started in oil & gas exploration before moving into entrepreneurship for sport event filming with commercial drones. He has advised European and Israeli startups on Go-to-Market, public, and private fundraising strategies, particularly in deep tech sectors such as MedTech/HealthTech, Biotech, ClimateTech, AI/ML, among others.

He has also been a Venture Scout for startups aiming for European Programmes such as The EIC Accelerator, combined with scouting for a German VC (pre-seed, DACH focused). Besides, he is an Angel Investor in a pre-seed Spanish Business Angel Group and Startup Lab Mentor at IE Business School.

Tomas joined EIT Digital Growth Services in 2024 to cover the South Europe Region.

OUR TRACK RECORD

scaleups supported

scaleup origin countries

offices in Europe

VCs in our network

PROGRAMME CRITERIA

28DIGITAL Growth Services works with fast-growing companies leveraging digital technologies who meet the following criteria:

- 1m€ of annual revenues or 4m€ funds raised

- Headquarter in the EU, the UK or in one of the Horizon Europe associated countries

- Looking to raise €5M to €25M funding

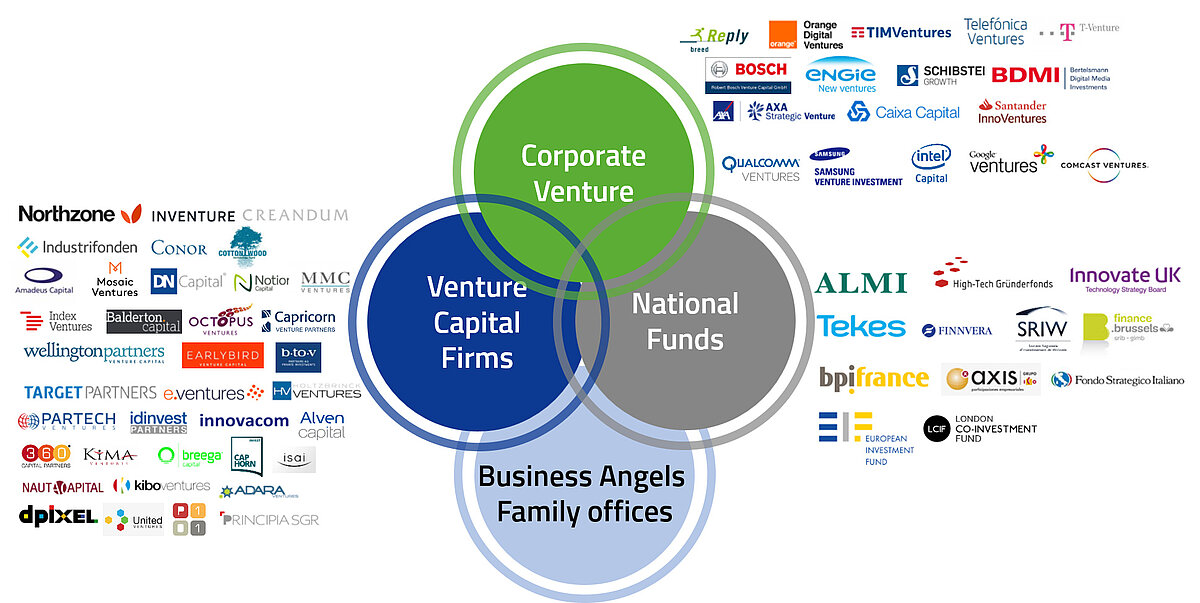

AN UNRIVALLED NETWORK OF INVESTORS ACROSS EUROPE

An overall expertise in structuring international rounds with: